Getting ready for Brexit

Pallet2Ship® - SUPPORTING OUR CUSTOMERS THROUGH BREXIT

Pallet Delivery - Preparing for Customs Borders with the EU

At Pallet2Ship®, we're here to help our customers ship to/from EU post Brexit.

As the Brexit transition period will end on 31st of December, new trading rules will apply starting on 1st of January 2021. However, negotiations for a new Free Trade Agreement are still in progress. Your business must be ready whether you already ship inside of the EU, or you are planning to do so in the future.

Until this date, shipments continue to move between the UK and the EU as before, and our services remain the same.

Our carriers are currently making major changes regarding post Brexit shipping procedures, including preparing for the eventuality of there being no trade deal agreed, so the UK will become a “third country” trading with the EU under the World Trade Organisation's rules and regulations starting January 1st 2021.

Pallet2ship will keep you updated regarding everything you need to know about pallet delivery to and from the EU post Brexit and we have already made important changes to the website so once the UK leaves the EU, all the necessary paperwork is handled in the most efficient manner, online.

Even after Brexit, customers can still benefit from cheap pallet delivery rates to/from Europe, and we are focusing on maintaining the same high standard of service we have been providing for over 12 years. We are in a very strong position to continue offering the same high level of customer service and value for money and our UK and the EU experienced operations teams will be available to help you beyond the 31st of December 2020.

Currently, all of our pallet shipping services are operating as usual, and no further steps are required to ship your goods into the EU or from the EU into the UK. To learn more about how you can prepare your business for Brexit, please refer to the Pallet2ship guide, below:

How is pallet shipping to the EU going to change from 1st of January 2021?

What we know:

- Great Britain (England, Scotland, Wales) will no longer be part of the EU Customs Union.

- Shipments between GB and EU will require customs clearance.

- Additional data and paperwork will be required with each shipment.

- Duties and Taxes are likely to be charged at the point of import into GB or the EU.

What we don't know yet:

- Will there be a Free Trade Agreement or will trade be on WTO Terms (Customs Duties).

- How the Northern Ireland Protocol will be implemented.

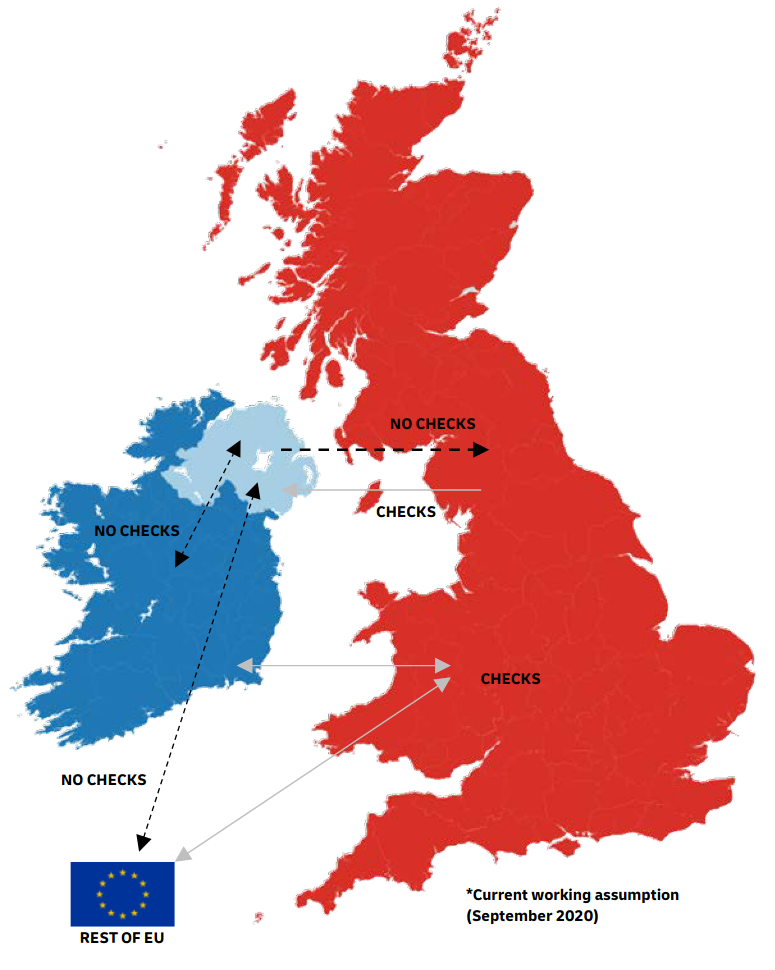

Northern Ireland Protocol

Regarding the movement of goods between Northern Ireland and Great Britain (England, Scotland, Wales), the UK Government has released a Protocol document. The document is focusing on 4 types of shipments:

- Shipments coming from GB, going to Northern Ireland may be subject of clearance process, but no taxes or duties will be involved.

- Shipments coming from Northern Ireland, going to GB, apart from a few exceptions, will continue as they are today.

- Shipments between Republic of Ireland and Northern Ireland will move freely.

- Northern Ireland to/from any other EU countries: These shipments will move freely, no extra documentation required.

Changes to UK VAT treatment

Starting on the 1st of January 2021, for most consignments not exceeding £135 in value, instead of VAT being collected at importation or delivery to the customer, VAT will be accounted for at the point of sale. Consignments above that value will remain subject to the existing customs rules and processes where the receiver is responsible for paying the duty upon importation/delivery. The changes will not apply to consignments of goods containing excise goods or to non- commercial transactions between private individuals. Existing rules will continue to apply for these transactions. For more details, please access this link:

https://www.gov.uk/government/publications/changes-to-vat-treatment...

Brexit at a glance

Here at Pallet2Ship®, we put our customers first and aim to give you the most up to date information. Please see the information below regarding required documentation for shipments post Brexit.

IMPORTANT! Information on EORI numbers

Considering shipping goods to/from Europe? In the UK, businesses, self-employed and private individuals involved in a commercial transaction must register, the same for businesses and self-employed within the EU, so before exporting/importing it is essential to make sure that both you and your customers/suppliers in Europe have the EORI numbers (unless your EU customer is a private individual and the goods in question are personal effects, in which case they do not need it)

Register for an EORI number now

Collect from |

Deliver to |

Commercial Invoice(for goods that are subject of a sale) |

Proforma Invoice(for personal effects) |

VAT * |

EORI ** |

|---|---|---|---|---|---|

| Great Britain | Europe | ||||

| Europe | Great Britain | ||||

| Northen Ireland | Europe | ||||

| Europe | Northen Ireland | ||||

| Northen Ireland | Rep. of Ireland | ||||

| Rep. of Ireland | Northen Ireland | ||||

| Great Britain | Northen Ireland | ||||

| Northen Ireland | Great Britain | ||||

| Rep. of Ireland | Great Britain | ||||

| Great Britain | Rep. of Ireland | ||||

| Rep. of Ireland | Europe | ||||

| Europe | Rep. of Ireland |

What about your business? Are you prepared to ship to EU after Brexit?

Are you already trading outside the EU?

If you are already trading outside the EU you will be familiar with exports/ imports, customs requirements and certain documentation needed for clearance. Nonetheless, the following information could still be valuable in helping you ship your pallets or parcels to/from the EU after 1st January 2021. Please review the sections containing information on EORI numbers, Commodity Codes and Incoterms in particular.

Are you trading within the EU only?

Pallet and parcel delivery to and from Europe will soon change. If you are currently only shipping within the EU now is the time to familiarise yourself with all the information available on our website, mainly with the future customs procedures and the required documentation, which will help you better understand the customs clearance process.

Brexit Fee

From 1st January 2021, Pallet2Ship® will apply a charge (imposed on us by the carriers) on all dutiable shipments between the UK and EU countries, both inbound and outbound. With the information that is currently available we cannot clearly say how much this fee will be since this will depend on each carrier, however our promise to customers is to try to keep these extra costs to the absolute minimum. This fee will be introduced regardless of any trade deal agreed by the UK and EU, as the following will still apply:

- Customs requirements for all shipments between the UK & EU. This results in an increase in the number of declarations, licenses, data submissions, overall processing, plus new IT systems.

- Border formalities will be introduced that must be complied with, i.e. the new ‘Border Ready' requirements in Kent.

- Increased Bond storage facilities and associated security. The fee is applied per kg as heavier shipments in general have more complex customs requirements.

- Increased regulatory requirements restricting commodities into Europe.

How to prepare as an exporter?

Pallet2Ship® will help you understand the 4 key steps we believe will help your business be ready for shipping pallets or parcels into Europe from 2021 onwards.

What documents will you need if you are an Exporter?

- Commercial Invoice:

Firstly, whether or not you've already completed a Commercial Invoice

before, Pallet2Ship® are here to help. We offer you an integrated

solution so you can generate your own commercial invoice on our

website immediately after placing the booking. As a matter of fact we

would like to encourage all our customers to deal with their

commercial invoices or pro-forma invoices immediately after paying for

their booking, to avoid delays, failed collections or extra charges.

To keep things simple and make sure that ALL our carriers and Customs Officials benefit from the same standardised Commercial invoices, Pallet2Ship® have made the decision of accepting online generated commercial invoices only, so you will only be able to do this on our website.

We strongly believe that in the long run this approach will bring much needed clarity, allow us to deal with high volumes of freight and benefit both customers and suppliers, since the goods will move through Customs at a higher pace, with less issues. - EORI number: An EORI number is an Economic Operator Registration and Identification number, needed to move your goods through Customs. You currently only need an EORI number when trading with countries outside the EU. However, a GB EORI number will be required for UK imports and exports from 2021. The EORI number must be included on your Commercial Invoice. If you don't already have an EORI number you can apply for one here.

- Incoterms: These are a widely-used terms of sale, and a set of 11 internationally recognized rules which define the responsibilities of sellers and buyers. Incoterms specifies who is responsible for paying for and managing the shipment, insurance, documentation, customs clearance, and other logistical activities. Agree incoterms with your customer as they must be included on the Commercial Invoice. More info here.

- Commodity codes: The goods you are sending are identifiable via a precise, internationally-recognised commodity (Harmonised System) code. Every item will fall under a commodity code – and this commodity code dictates your duty rating, as well as alerts you to any import or export restrictions. This ensures the correct duties and taxes are applied by Customs. It can also be used to identify the duties and taxes applicable in each country you're sending to, but remember: the exact rates that will apply in the EU for UK shipments are yet to be agreed. The commodity code must be included on the Commercial Invoice. More info here.

How to prepare as an Importer?

As one of the UK’s main freight brokers, with high volumes of imported freight booked on our online system, Pallet2Ship® wants to continue in helping our customers ship their goods as smoothly as possible from Europe to the UK.

What documents will you need if you are an Importer?

- EORI number: You must ensure you have a valid EORI number. An EORI number is an Economic Operator Registration and Identification number, needed to move your goods through Customs. You currently only need an EORI number when trading with countries outside the EU. However, a GB EORI number will be required for UK imports and exports from 2021. The EORI number must be included on your Commercial Invoice. If you don't already have an EORI number you can apply for one here.

- Appoint a customs broker. Pallet2Ship® can act as your Customs broker*

- Consider a deferment account: If you will be a regular importer with duty and taxes to pay you may find a deferment account helpful to your business. For details on how to apply for a deferment account and when this can be used please check your local authority website. https://www.gov.uk/guidance/setting-up-an-account...

- Be prepared to account for duty & taxes: The person or business receiving the shipment is legally obliged to pay Duty & Taxes (VAT) unless the sender has agreed to accept these charges in the contract of sale (this will be shown by the Incoterm used).

* Pallet2Ship® acting as your broker will make sure that customs clearance at both export and import will be as smooth as possible to deliver your shipment without delays.

To do this we ask you to provide us with the following details:

- Commercial invoice and other supporting commodity/country specific documentation

- Company name and address details

- Contact details for clearance instructions/queries

- EORI/VAT/TAX numbers

- POA or authority to act on your behalf

- Deferment account details and authority to use it if you have one

- Specific clearance instructions

- Details of any authorisation numbers we might need to effect clearance

If you have an enquiry, please let us know, we're here to help. Besides offering our shipping help, we also welcome your feedback on our website.